Insurance companies, known for relying on old-fashioned and inflexible legacy systems, face numerous challenges when trying to transition into digital transformation and stay competitive in the increasingly technological business world.

However, they can turn to low-code applications as potential solutions for modernising their operations.

Research suggests that by the end of 2024, 80% of technology development will be led by non-IT professionals, with more than 65% adopting low-code or no-code solutions.

This means insurers can now use these emerging trends to accelerate development cycles and optimise resource management, allowing them to focus on their core strengths – delivering value to their customers.

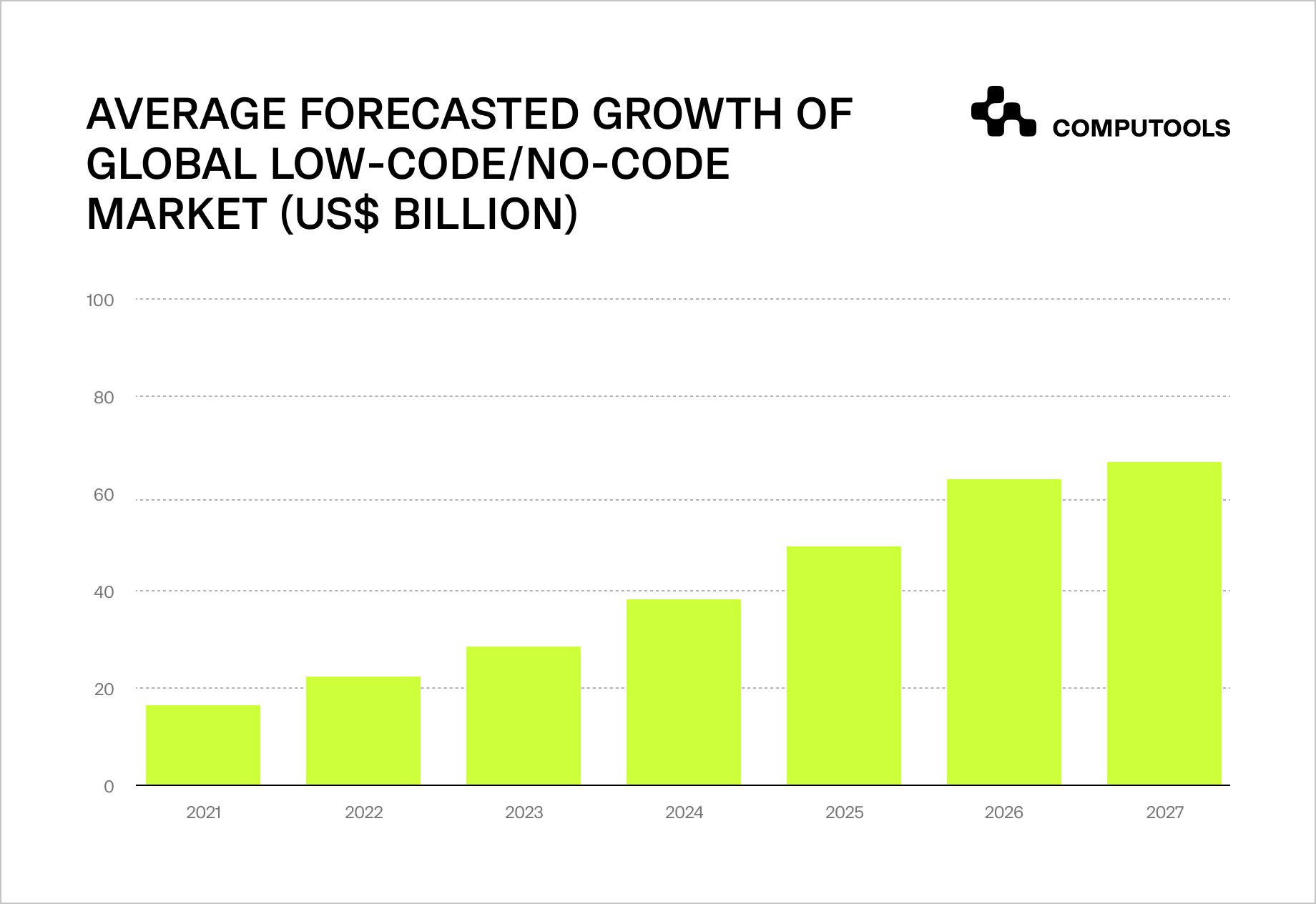

It’s no wonder that the worldwide low-code platform industry is expected to hit US$65 billion by 2027. But how exactly can insurance companies benefit from low-code technologies, and what specific platforms should they explore for future expansion and digital transformation? Let’s find out.

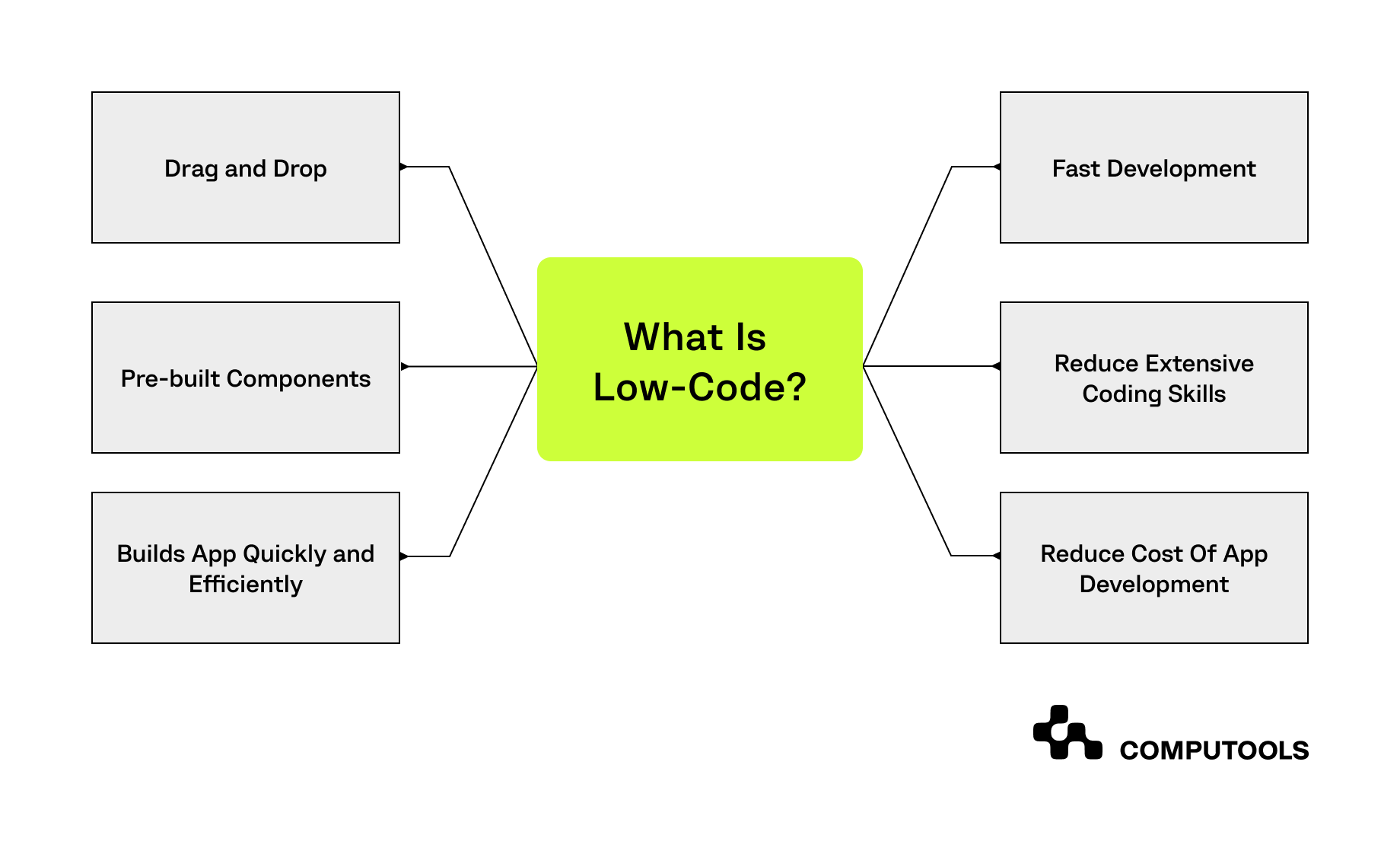

What Is Low-Code?

Low-code development smartly addresses the challenges of high technology talent demands and engineer shortages.

This method allows for building software applications with significantly less coding than traditional development, as low-code platforms utilise visual interfaces, drag-and-drop capabilities, and automation tools to simplify app creation.

This approach is generally quicker and easier than the established one, allowing not only insurance software development services providers but also those with a few coding skills to build web and mobile applications.

Low-code support model-driven development, meaning they are open, extensible, and accommodate manual coding or scripting, combining rapid development advantages with no need to rewrite basic code repeatedly.

These platforms also scale well through open APIs, improving reusability for either cloud or on-premises deployment.

Developers maintain control over application testing and can effectively manage quality and performance-related tasks.

In the insurance settings, low-code solutions allow professionals to develop mobile apps or websites with limited resources, making customer interactions with their insurance business seamless, and reducing the need for phone calls or office visits.

Furthermore, low-code platforms help insurance companies stay competitive in the quickly changing business environment, enabling them to innovate faster than traditional software development teams amidst constantly emerging new technologies.

How Low-Code Is Solving Challenges In the Insurance Industry?

The insurance industry has existed for centuries, offering protection for both people and businesses. Despite this, the traditional ways of operating within this sector have mostly stayed the same.

Insurance legacy systems typically feature scattered databases and manual processes, creating inefficiencies and data silos that undermine operational efficiency and cause customer dissatisfaction.

How can low-code app development make a difference? Let’s explore.

1. Automate the insurance value chain

As mentioned above, insurance companies often deal with outdated systems that need careful dismantling rather than abrupt removal.

These businesses usually operate multiple insurance platforms to meet their company requirements.

Instead of a complete technology revamp, which can be risky and expensive, the low-code approach allows insurers to deliver relevant digital solutions that address business challenges.

It also enables them to integrate with existing systems during a gradual digital transformation.

2. Streamline underwriting processes

Insurance underwriting must be both quick and accurate, as one cannot be compromised for the other. Challenges such as manual data validation, information silos, and lack of scalability hinder the rapid delivery of quality underwriting.

Automating the underwriting process allows insurers to achieve more with the same resources. For instance, some low-code underwriting applications claim to enable insurance companies like CNA to cut the time spent on delivering quotes by up to 60%, making sure they stay agile and provide a top-tier customer experience.

3. Encourage talent diversity

The low-code solutions empower everyday users, known as citizen developers, to create products and services that truly connect with customers because they are designed by the product users themselves.

This decreases the need for highly skilled software engineers, freeing them to concentrate on more important matters like security, fraud detection, and data analysis, while citizen developers use easy-to-handle visual tools, like drag-and-drop features, along with rules, to build customisable and personalised products.

4. Help meet regulatory compliance

Insurance companies must adapt more actively to the industry’s quickly evolving regulatory standards, opting for insurance software development.

Low-code platforms serve as an excellent tool for aiding small and medium-sized insurers in meeting regulatory requirements by allowing them to quickly modify their workflows, business logic, rules, and user interface in just a few hours.

Consequently, insurance companies can redirect their focus towards clients, promoting a more user- and community-centred approach.

6. Enhance customer experience at lower costs

By putting technology into the hands of business users who are closer to customer demands, low-code programming offers a safer way to implement solutions that truly address business problems.

Business users or citizen developers responsible for pricing or distribution can use pre-existing workflows to create unique and innovative solutions.

7. Simplify claims management

Low code solutions simplify and streamline the claims management process by automating several steps, such as generating quotes, approving quotes, and submitting payments, among others.

These insurance claims management systems reduce the number of employees required in the process, which means fewer people have access to sensitive information about customers’ histories or claims.

This helps in preventing fraud more effectively than ever before, and it can also contribute to increasing profitability margins and loss ratios over the long term while simultaneously growing revenues over time.

Benefits of Low-Code for Insurance Businesses

Low-code development platforms offer numerous benefits to insurance businesses, such as enhancing organisational agility and enabling employees to create professional-grade apps that tackle business challenges quickly.

Here are several ways a low-code development platform can assist your business:

1. Accelerate market responsiveness

Traditional coding, debugging, and testing prolong the time-to-market. Using a visual development approach with low-code in the insurance industry can cut down the development time from months to weeks.

You can create Proofs-of-Concept (PoCs) in just weeks and fully implement them in a few months.

This rapid development pace gives insurers a quick competitive advantage and helps them adapt faster to changing customer demands and preferences.

2. Enhance scalability

It’s not a secret that customer experience drives growth. As insurance companies expand, low-code apps can scale effortlessly to meet rising volumes of work without the need for extensive code rewrites.

Updates are also easy to implement, ensuring that apps continue to meet the growing market requirements.

3. Improve cost efficiency

If the high upfront costs of overhauling legacy systems are daunting, consider that extensive training or complete system upgrades are not necessary.

Low-code platforms can integrate with legacy systems, using ready-made components to deliver necessary functionalities.

4. Boost agility

Low-code enhancements can serve as an additional layer atop legacy systems. This not only saves budgets but also allows companies to get used to new setups quickly—while still depending on existing software temporarily when needed.

Best Low-Code Platforms For Your Insurance Company

A good low-code insurance platform needs to be secure, scalable, and versatile enough to handle advanced processes, large databases, and sophisticated application features.

Here’s our guide on which low-code platforms to consider for your insurance company:

1. Microsoft PowerApps

This enterprise-level low-code platform offers high security and scalability with advanced features suitable for complex requirements.

And if you already use the Office Suite, integrating PowerApps for every employee is quite simple.

2. Outsystems

Designed for high performance, this platform excels in business process automation, cloud applications, and customer management tools.

3. QuickBase

Specialising in business process management and automation as well, QuickBase effectively addresses workflow and operational bottlenecks.

4. Integrate.io

This platform stands out in building on-cloud databases, data analytics, data warehouses, and ETL integration tools, catering to any industry and business size.

5. UI Bakery

UI Bakery is great for small and medium-sized businesses looking to save money. It offers more than 50 design components and integration tools. And it also works well with both cloud-based and on-premises setups, making it easy to automate different processes in your company.

6. Salesforce Lightning

Salesforce’s Lightning is their only low-code product, designed to create scalable cloud and mobile apps easily. It allows users to quickly build both basic and complex applications using reusable components.

Final Thoughts

An impressive 97% of respondents reported that their low-code experiences met or exceeded their expectations.

While low-code presents a remarkable solution for many insurance tasks, it’s essential to recognise that complex software solutions in the insurance industry often require more nuanced and comprehensive approaches.

It can certainly streamline processes and enhance efficiency, but addressing the intricacies of insurance operations may necessitate the expertise of dedicated teams.

It’s about striking a balance between leveraging the agility of low-code and recognising the value of specialised expertise in tackling the unique challenges of the insurance landscape.

To learn more about our expertise in the insurance industry, write us at info@computools.com and gain insights into our operations.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”