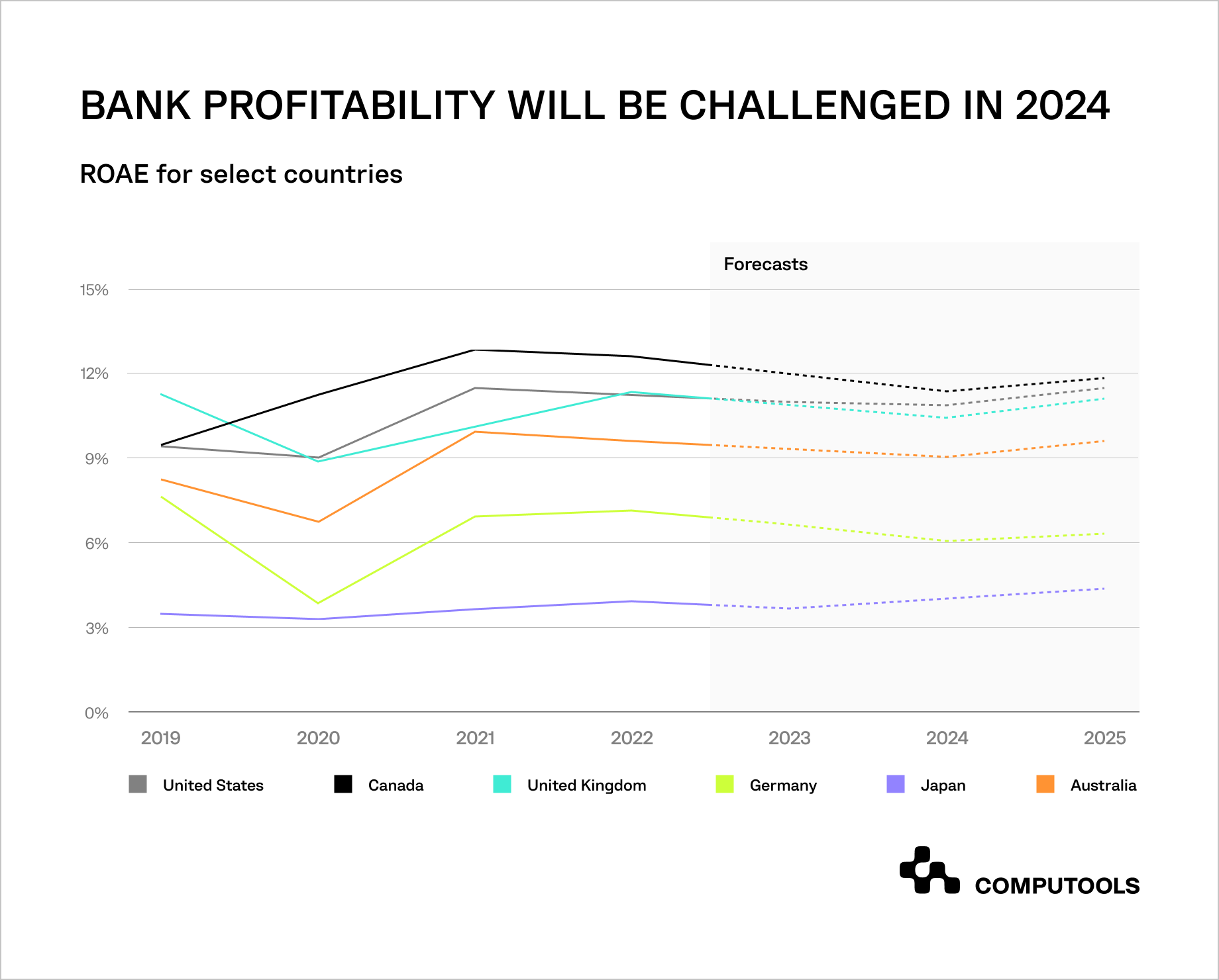

A weakening global economy and a changing economic environment will present banking challenges in 2025. Banks’ capacity to control expenses and make money will be tested in new ways.

This year the effects of decarbonization, fraud, open data, embedded finance, generative AI, industrial convergence, custom banking software development, and digitalization of money will all be more pronounced.

Although revenue models will be tested, banks are generally in a strong position. Little organic growth will push organizations to look for new revenue streams when money is tight.

The early 2025 global financial shocks have prompted a reevaluation of industry plans. There is still more to be done to develop business models, even as bank executives concentrate on the planned regulatory changes to capital, liquidity, and risk management for banks.

We have done a thorough research and highlighted the major challenges faced in the way of banks’ margin growth and picked up ways to address these challenges.

CHALLENGES OF THE BANKING SECTOR AND THEIR SOLUTIONS

The outlook emphasizes that for banks to thrive in 2025, they must balance innovation with stability, while also meeting evolving customer and regulatory demands.

1. ONLINE AND MOBILE PAYMENTS

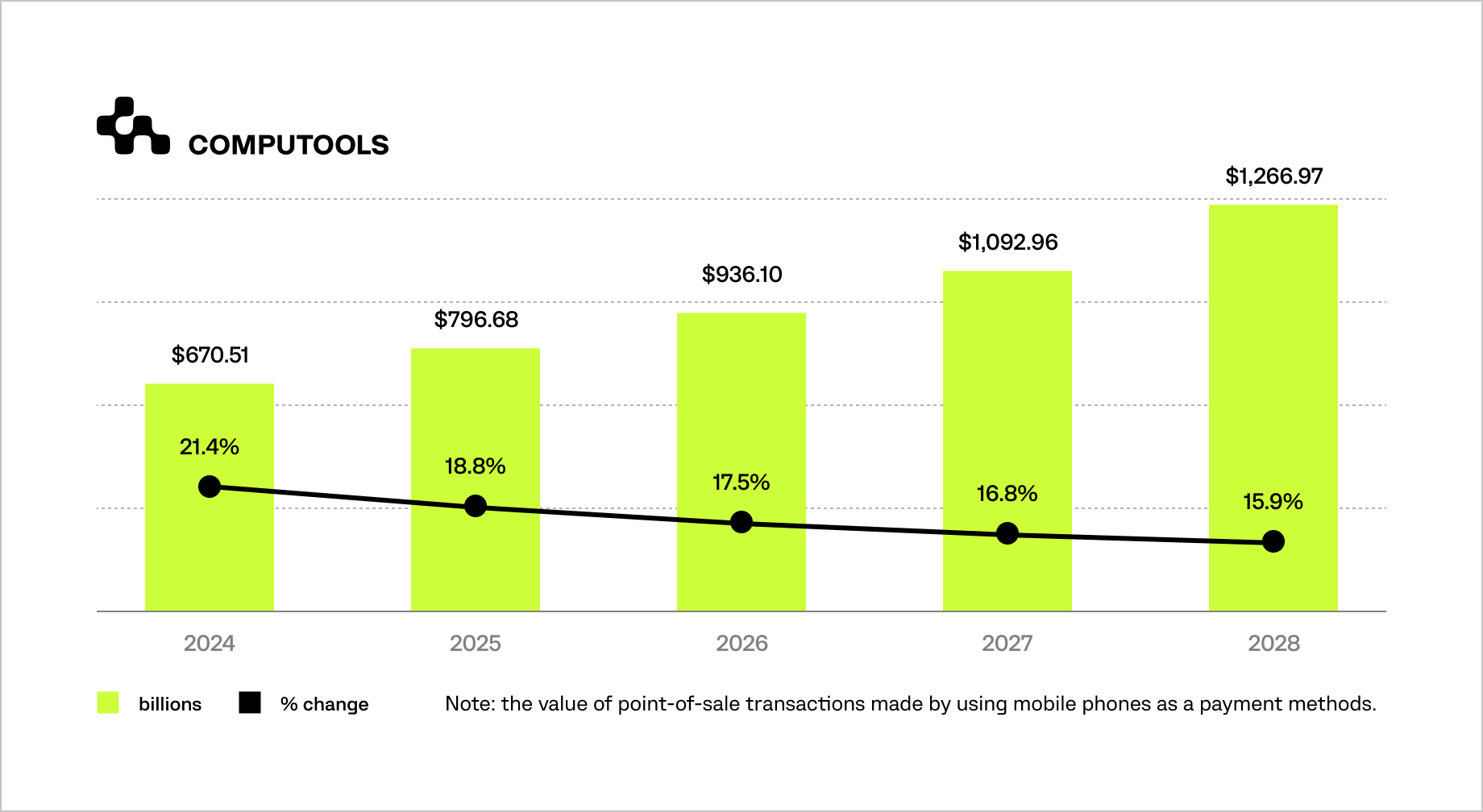

One of the most dynamic and disruptive parts of banking is still payments. Global competition is getting fiercer and customer expectations are rising as a result of innovations.

The pursuit of seamless digital payment experiences persists, as friction is inherent in nearly all historical payment systems.

As of Q1 2024, PayPal, for instance, crossed approximately 427 million active users worldwide. Apple Pay and Amazon Go are adding new users rapidly.

Similarly, Tencent and Alipay are setting new records for digital payment transactions in China.

By 2027, digital wallets will account for 31% of in-store sales, twice as much as they did in 2023.

In the same time, there will be a 37% increase in BNPL users, reaching 112.7 million. Even while the number of cryptocurrency payers is still relatively low, between 2021 and 2025, it is expected to nearly quadruple to 5.0 million. Gen Zers and millennials drive growth in each of these scenarios.

Pay fee growth is expected to become increasingly challenging for card issuers in 2025. It can be challenging for card issuers to raise fee income due to pricey reward programs and less expensive digital alternatives from unconventional players.

Banks will face this challenge in 2025. They will have to become faster, more efficient, and cheaper for both consumers and businesses.

Solution. Simple payment options increase the frequency of transactions and allow banks to grow their customer base internationally, solving a major challenge.

Mobile technology in financial services is the best way to hold and satisfy a customer. With advanced security like biometric authentication and new customer needs, payment systems are improving mobile services and online products by leveraging AI development, big data, IoT, and blockchain.

Remember: over 70% of payments are fulfilled via mobile devices. 67% of millennials don’t have a physical card.

These days smartphones are often the only way people shop, entertain, do business, or do anything digital. Contactless cards are seen as the new normal.

The experts claim that the appearance of digital-only banking is the first step in the evolution of the entire banking industry.

Tell us about your banking software needs and we’ll be in touch within 20 minutes.

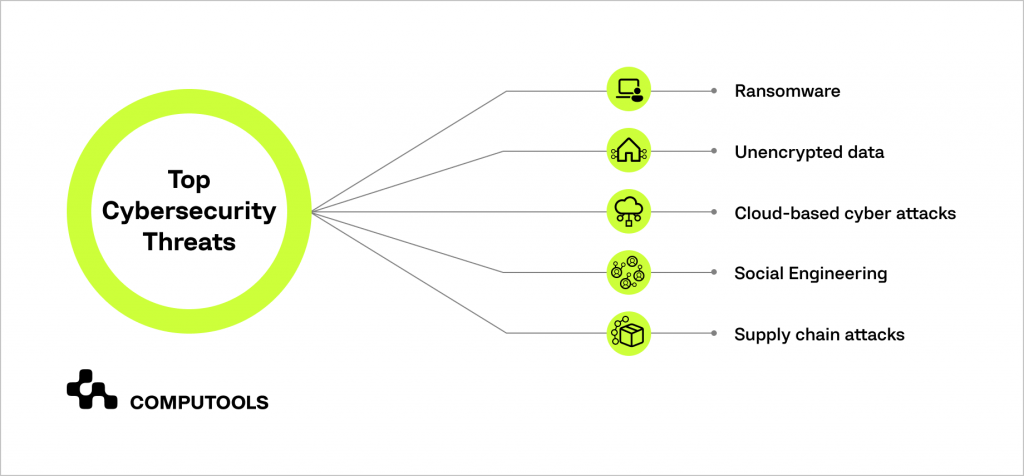

2. CYBER-SECURITY

For apparent reasons, hackers and fraudsters are challenges of banking sector.

Casey Merolla says, “Banks face a delicate balance between customer experience and fraud management: while prevention practices can create friction, and a declined customer is often an unhappy customer, fraud events can result in lost relationships.”

The annual cost of financial crime to the world economy is $2.1 trillion, which is greater than the GDPs of Saudi Arabia, Pakistan, Switzerland, and Ireland all together.

The annual cost of AML compliance is $83.5 billion. Only 1% of the $2 trillion that is laundered annually gets discovered by officials. For the banking sector, fraud detection and security concerns are the major and expensive pain.

Solution. Machine learning and AI predictive analytics are two great methods and technologies for helping banks and their customers remain protected in the digital age.

These technologies can detect network intrusions, secure user authorization, analyze a company’s cybersecurity, and predict hacking.

Biometric technologies are believed to address security and privacy problems in finance industry with greater efficiency. The development of biometrics can help to prevent fraud and money laundering.

Moreover, users find instant authentication based on the iris and fingertips scanning more beneficial than the need for memorizing codes, pins, and passwords.

Blockchain technology is also a great troubleshooter when it comes to cyber-security.

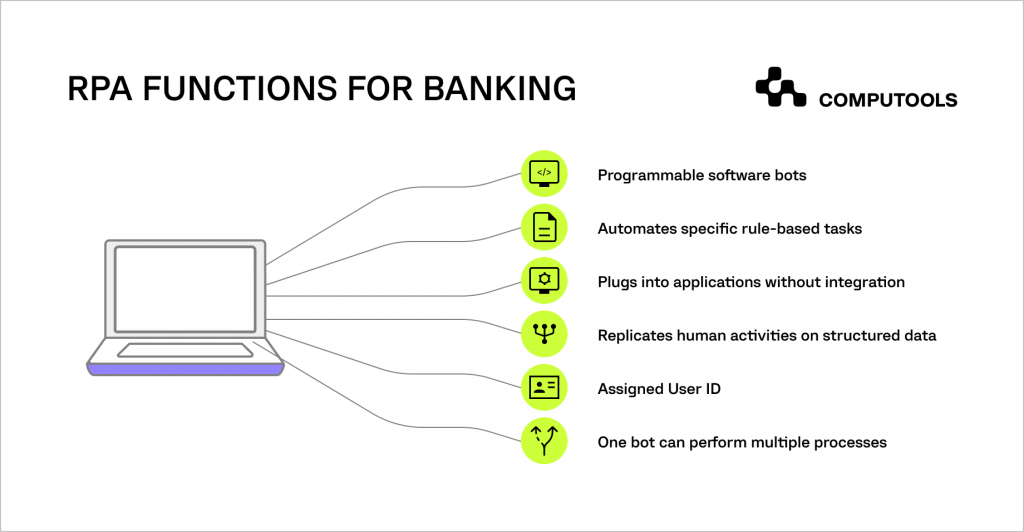

3. OPERATIONAL EFFICIENCY

With the more widespread adoption of virtual banking, banking firms have had to find a way to deliver their customers the best possible user experience. Internally, the challenge is to maximize efficiency and keep costs as low as possible while maintaining maximum security levels.

Automation is already significantly impacting asset management and other industries across the board.

According to the International Federation of Robotics (IFR), at a global level, the adoption of automation is accelerating, driven by increased global competitiveness, the need to boost productivity and the quality of services.

Solution. Introducing Robotic Process Automation (RPA) in Banking processs has been validated by the biggest banks in the USA and Japan several years ago, proving that technology creates efficiency, helping large organizations save money.

However, even small banks operate in a highly regulated industry and face high demands for auditing, security, data quality, and operational resilience.

RPA allows modern banks to meet these demands and achieve significant operational efficiency.

Moreover, surveys show that implementing automated elements into financial ecosystems brings many benefits, such as high returns, enhanced cross-selling, faster product and service delivery, higher customer satisfaction, and stronger financial health in the short and long run.

4. VIRTUAL CUSTOMER SERVICE

Customer service is a must for banks, whether they’re brick-and-mortar or virtual. Customer service is meant to solve customer problems in a friendly and quick manner while helping banks save money through speed and customer lifetime value.

A major challenge in the banking industry is large departments that aren’t using their human resources wisely (too many people doing too little). The question has remained: How can we enhance communication?

Solution. Chatbots in Banking have already proved they can help create a more positive experience. So what is a chatbot, and how can it solve banking issues today?

Chatbot technologies offer an automated, easy-to-use, launch-and-maintain system that promises to reduce customer care call volumes and increase satisfaction while potentially helping change customers’ opinions of banks.

Integrating chatbots into customer service systems increases clients’ loyalty, reduces processing time, and cuts administrative costs. Bots help to find transactions, send and receive money, lock and unlock debit cards and much more.

5. ADVANCED TECHNOLOGY

A major challenge for banks today is the adoption of new technology. Due to legacy solutions and out-of-date business processes, larger organizations have a hard time adopting new processes and tools, making it—according to experts—the biggest challenge in the financial industry for 2025.

Despite proven effectiveness in other financial sectors, banks are in no hurry to apply artificial intelligence, blockchain, or cloud app development actively.

Meanwhile, recent studies show that customers expect to receive service from banks with minimal participation of consultants. For the modern consumer, the autonomy and reliability of banking services are essential.

Solution. Banking software development offers revolutionary solutions for the banking industry.

A great example is AI chatbots. In addition, some banks in more digital parts of the world have already implemented VIP solutions that include video and voice chat.

6. VIRTUAL TRANSACTION AUTHENTICATION AND SECURITY

Reading the figures is challenging. Over 105 million victims—a 72% increase in only six months—were impacted by data breaches at the end of Q3 of 2022.

Furthermore, according to Forbes, fraudulent transactions resulted in the loss of $3.1 trillion in 2023, with an average of almost $100,000 per instance.

With most of the population using credit cards as a primary form of payment, businesses all over the globe offer payment solutions that accept credit cards, however, due to the high fraud rate, banks are struggling to implement solutions that work with authenticating and securing virtual payments.

Solution. Blockchain is discussed as the solution to issues around official authentication and security of virtual payments.

Extreme transparency and comprehensive codes are proving to be the safest form of transaction protection against fraud and hacking, increasing the reliability of banking transactions several times over.

Storing data is another regulatory concern banks are faced with. Cloud computing is a great way to assure maximum safety and reliability.

7. INVESTMENT BANKING

In most cases, investment banks operate as intermediaries between parties needing capital and parties with money to invest.

Economic and financial challenges have impacted investment banking performance. Investment banks, big or small, division or full-serviced, are now under strict regulations and substantial operational costs.

Traditional investment banking models in the current market cannot achieve success. Therefore, there’s a critical need for re-balancing priorities, goals, and future resources.

Solution. Investment banks can reduce headcount and manage talent through the effective incorporation of fintech software development services, such as AI Robo-advisors.

Just like every other business, investment banks are seeing a growth in demand for seamless digital banking capabilities and client-centric experiences in 2025.

It is now essential to draw in and keep customers who demand extremely individualized experiences.

Banks are leveraging artificial intelligence to meet this expectation by employing data analysis to offer things like personalized service plans and financial guidance based on each customer’s particular requirements and circumstances.

This raises customer happiness while also giving banks useful information about patterns in consumer preferences and behavior.

Investment banks will have a competitive advantage if they innovate and make investments in their customer experience. This benefit will manifest as “stacked wins”—higher returns, quicker growth, and reduced expenses.

Specialization is a key and desirable trend among investors and capital seekers. Investment banking should focus on core business and collaboration with third parties.

The overall development of technology is both an opportunity and a challenge for investment banking.

Product and service packages should include AI, blockchain, robotics, and cybersecurity technology. In addition, it will help uncover new sources of income.

8. CUSTOMER EXPECTATIONS

Currently, banks face a split opinion from customers about the service they want to receive: online vs offline.

That said, both types of customers want to receive benefits quickly, conveniently, cheaply, and to the fullest extent.

Whatever the case, customer expectations are what initiate transformation.

Financial institutions must use scalable strategies to evolve, otherwise the lack of customization and personalization will have consequences:

• increased costs

• slowed business agility

• poor customer experience

• loss of operational resilence

• revenue loss

• hampered influence in market

• hampered ability to improve services

Solution. It’s not enough for banks to be present online and have physical branches and ATMs. They must implement change on many levels: technology upgrades, staff training, and management changes.

The introduction and development of customer loyalty programs will help build customer trust and retention. At the same time, new customers need to be enticed through multi-channel marketing.

For all these innovations to be introduced consistently and smoothly, the banking industry needs to improve staff digital literacy and top management digital expertise.

9. BANKS AND FINTECH COMPANIES COMPETITION

Fintech companies have rapidly gained momentum and can seriously compete with traditional financial institutions.

Web and mobile apps can already give loans, operate with cryptocurrency, and even offer financial advice.

Solution. Fintech companies can’t fully compete with large international banks, but they can crush small regional ones. As a solution, smaller banks can offer cooperation with fintech tools to compliment the gaps within their organization.

Banks should incorporate more digital elements into their physical offices to outperform their competitors.

Touchscreen technology, digital signgates, and video walls will help not only keep people interested but also engage them on the spot: inform them about the services, and update them on innovations.

It’s not just an interactive element; it also allows eliminating paper content and catches the attention of younger generations.

10. SOCIAL MEDIA ENGAGEMENT

Social media is essential to business in 2025 and beyond. The graph shows monthly visits to social platforms by millions of people.

Undoubtedly, social networks can become a mecca for any business. The main thing is to choose the right target audience.

Can social media be a place to attract new customers for banks? To what extent can this industry’s audience be engaged through social media?

Solution. Simply registering an account on all social networks is not enough. Banks don’t need a presence for presence’s sake.

However, there are platforms where this industry can bring significant growth to the sector through what the sector can give the customer for free; for example, helpful information on a YouTube channel with tips or advice on a particular topic. Various contests also stimulate audience engagement.

The banking industry has only begun to scratch the surface concerning the potential of AI, machine learning, chatbots, and advanced technology.

It is the ability to collect insights and apply advanced analytics that will benefit consumers and solve banking challenges in 2025.

11. OPEN DATA, EMBEDDED FINANCE AND INCREASING REGULATIONS

Banks are required to support the sharing of specific data elements that may not have been previously shared, such as bill payment data and particular terms and conditions.

These requirements necessitate not just minor adjustments but a comprehensive transformation of banks’ data handling systems.

The financial sector is pushing back against the proposed deadlines, with major banking associations requesting a two-year extension. They argue that rushing implementation could compromise customer service and increase risks to data security.

One of the key challenges in retail banking industry is the need for banks to standardize the way financial data is formatted when shared with consumers and third parties.

In short, compliance with the CFPB’s rules represents both a technical and strategic challenge for banks, requiring significant investments in technology and system overhauls to handle the evolving landscape of open banking.

Solution. Banks need technical changes, including the development of application programming interfaces (APIs) and developer interfaces.

Additionally, the new rules effectively prohibit practices such as screen scraping and credential sharing, which were previously common methods of accessing financial data.

12. TALENT MANAGEMENT AND SKILLS GAP

To be innovative and develop new financial services and products, banks need to have strong digital capabilities or partner with digital agencies for banking software development.

In an increasingly digitalized business, it is critical to stress that sophisticated digital skills are not only vital for ensuring customer happiness but also for strong cyber security and regulatory compliance.

The International Data Corporation has revealed that investment in digital transformation will soar to an astounding $3.4 trillion by 2026.

The World Economic Forum has taken note of this issue and released strategies aimed at helping businesses close the digital skills gap. This is an urgent task.

Solution. Banks should think about investing in extensive training and development programs for their current staff in order to close the skills gap in digital technology.

Bridging this gap can also be achieved by aggressive recruitment of job seekers who possess the requisite skills in the labor market and cooperation with educational institutions. In the digital age, it is critical for banks to continue being safe, competitive, and relevant.

With its inclusive and pro-diversity attitude, the Digital Skills Passport offers a useful way to enable skills-first discovery for internal talent identification and promotion. It also offers tailored learning and development possibilities.

Making sure the C-Suite, Heads of Diversity, Learning and Development, and Recruitment are aware of the areas where funding is needed to close the skills gap is essential to success.

Conclusion

Unfortunately, not every institution is ready to place new technology in the finance industry high on the priority list of investments. However, financial institutions should not ignore the potential of technology and how it can transform an organization.

However, if you are among those who are forward-looking, contact us at info@computools.com, and we will help put your financial institution miles ahead of the competition.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”