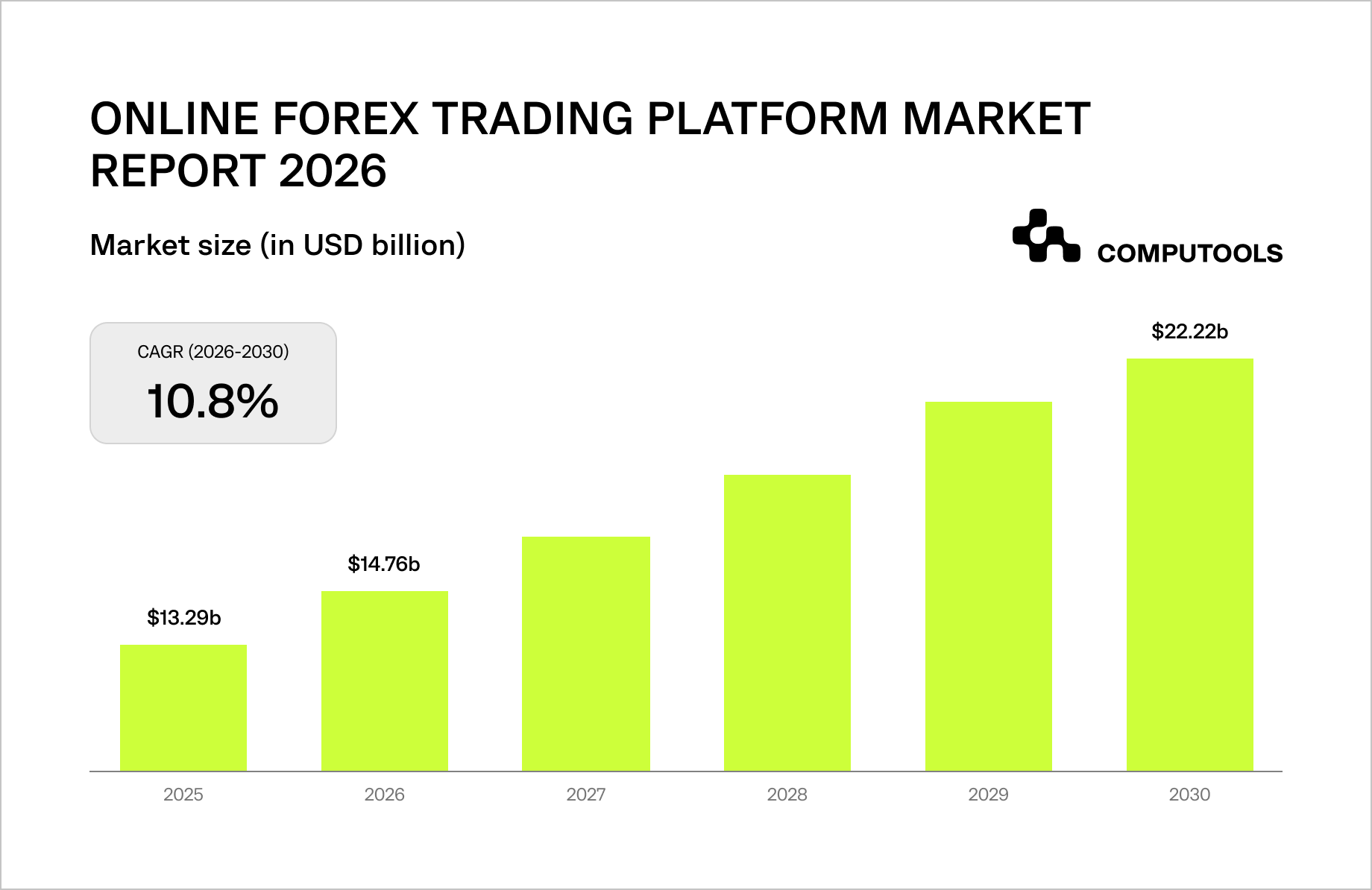

The online Forex trading platform market continues to grow fast, and in 2026, companies planning to build forex trading platform solutions are already operating in an environment defined by double-digit growth and significantly higher user expectations.

Market projections indicate that the industry is on track to exceed $20 billion by 2029, with an average annual growth rate of around 11%. This is driven by rising global currency trading volumes, the expansion of mobile trading, the popularity of social and copy trading, and the growing participation of retail investors.

For companies, the competition is no longer focused on feature lists or visual design alone. In 2026, traders expect true real-time order execution, stable live pricing, and predictable platform performance during peak market volatility. Any delays, requotes, or execution failures during high-impact market events quickly translate into loss of trust, reduced trading activity, and customer churn.

For CEOs and operational leaders, audience growth without proper trading IT infrastructure risks revenue and reputation. CTOs and CPOs face challenges at the architectural level: real-time platforms struggle under load when market data, execution, and risk controls are tightly linked. This causes latency, failures, and inconsistent balances.

By 2026, the crucial question shifts from whether to enter the Forex market to how to develop a scalable platform with real-time execution that grows with the business. Without a well-designed execution architecture and robust risk controls, market growth can work against the company, limiting its ability to fully capitalize on the global Forex opportunity.

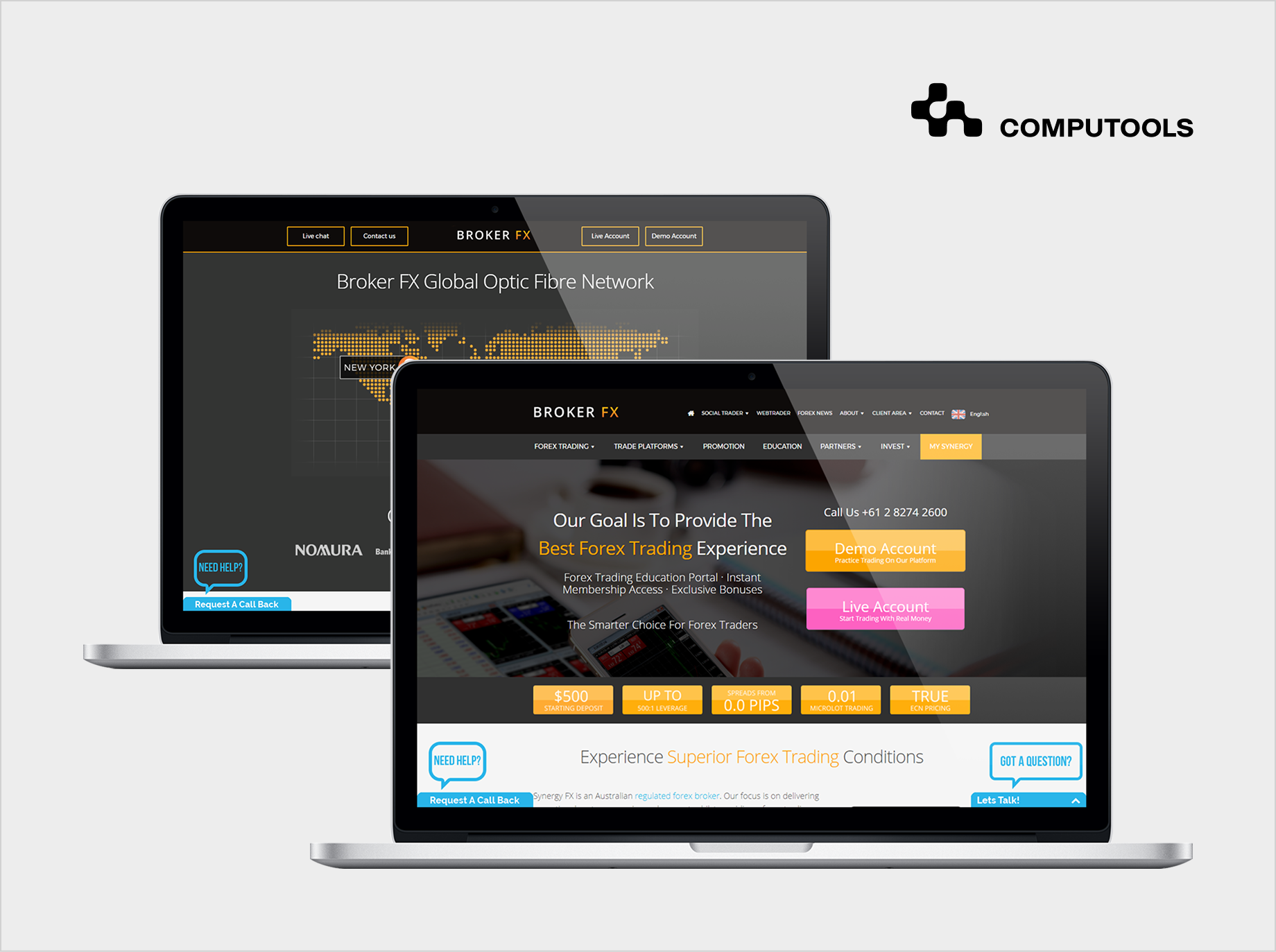

How we built a scalable Forex trading platform for Synergy FX

In 2026, many Forex brokers face the same structural issue: their trading capabilities scale faster than their digital entry points. Even companies with strong execution and regulated operations face growth limitations when client-facing platforms fail to handle traffic spikes, support regional expansion, or maintain consistent performance. This is a pattern that teams delivering investment software development services increasingly observe across the Forex market.

Synergy FX, a global Forex broker, faced this exact challenge. While the company offered fast execution and transparent pricing and operated in a regulated environment, its online presence did not fully reflect those strengths. The existing platform was not designed to handle increasing traffic volumes or support regional growth, creating friction between the broker’s operational capabilities and the trader’s first interaction with the brand.

Working closely with the client’s internal IT team, we focused first on the digital layer as a standalone acquisition and communication system. The solution emphasized clear structure, predictable behavior under load, and customer-focused UX/UI requirements that are essential for a real-time forex trading platform, even before a user reaches the execution layer.

To support this approach, web development services were applied as an architectural measure. The platform was built to scale content, regional pages, and messaging independently of internal trading systems, allowing Synergy FX to grow its online presence without introducing operational risk. As a result, the broker gained a scalable digital foundation that improved online sales, strengthened user engagement, and supported long-term business growth.

Below, we outline the core steps teams need to follow when building a Forex trading platform with real-time execution, drawing on hands-on delivery experience in regulated financial environments.

Step-by-step guide: how to build a Forex trading platform with real-time execution

Step 1. Define the business model, execution expectations, and regulatory scope

Building a Forex platform starts with fixing the business and regulatory boundaries before any architectural or product decisions are made. At this stage, teams must clearly define who the platform serves, how orders are expected to be executed, and which jurisdictions and regulatory regimes apply. Execution models, transparency requirements, and audit obligations directly influence system design and data flows.

This step is foundational for any forex trading app development initiative. Without explicit definitions of execution behavior, acceptable latency, and compliance requirements, technical teams are forced to make assumptions later, often resulting in costly redesigns or regulatory gaps once the platform is live.

Equally important is deciding whether the platform will remain Forex-focused or expand its asset coverage later, because that choice affects data models, risk logic, and long-term scalability.

In the Synergy FX project, the first alignment happened at the business and positioning level. Together with the client’s internal IT team, we clarified how the broker’s regulated status, ECN pricing model, and focus on transparency should be reflected in the digital experience and expertise. This initial alignment shaped the information architecture, messaging hierarchy, and content structure, ensuring that the platform consistently conveyed regulatory credibility and execution discipline at every user touchpoint.

Step 2. Translate “real-time execution” into measurable system requirements

“Real-time execution” only becomes actionable when it is expressed as measurable system constraints. At this stage, teams must define concrete performance targets, such as acceptable latency ranges, peak concurrency levels, and execution behavior during volatility spikes rather than relying on abstract notions of speed.

These requirements are critical for designing a reliable online forex trading system. They determine how components are sized, where buffering is acceptable, and which failures must be prevented at all costs versus handled through graceful degradation.

Formalizing these constraints early also creates a shared reference point for software engineering, operations, and product teams, reducing ambiguity and preventing misaligned expectations as the platform scales.

Although execution engines were outside the scope of the Synergy FX engagement, these constraints still shaped the digital layer. The platform was built to remain responsive and predictable as traffic increases and regional expansion occurs. By anticipating growth-driven load and avoiding tight coupling among content, onboarding, and internal systems, the solution enabled Synergy FX to scale its online presence without disrupting core operations.

Step 3. Design a modular architecture that separates execution from user-facing layers

A reliable Forex platform must be designed around strict separation of concerns. Execution, risk checks, and state management should operate independently of marketing, content, and acquisition layers. This approach reduces systemic risk and allows each component to scale according to its own load profile, an essential requirement for building a scalable forex trading platform that remains stable under market volatility.

In practice, this means isolating the trading core—order intake, validation, execution routing, and balance management— from presentation layers such as websites, landing pages, and regional content. When these domains are tightly coupled, non-critical updates (for example, content changes or campaign launches) can introduce latency or instability into execution paths, especially during periods of high market stress.

A modular architecture also enables teams to evolve the platform incrementally. Execution logic can be optimized for performance and resilience, while user-facing layers can iterate faster to support growth, localization, and conversion optimization without putting trading operations at risk. This separation is foundational for any regulated Forex platform operating at scale.

In the Synergy FX project, this principle was applied at the digital entry layer. Working closely with the client’s internal IT team, we treated the website and regional pages as a standalone acquisition and communication layer rather than part of the trading core.

The platform was built on WordPress with targeted PHP customizations, enabling the client to scale content, launch regional versions, and update messaging without impacting internal trading systems.

UX/UI design focused on clarity, transparency, and regulatory credibility, ensuring that the first user interaction aligned with the broker’s execution and compliance standards, while keeping operational risk isolated. This separation enabled Synergy FX to expand its digital presence and improve conversion rates without introducing dependencies that could affect trading performance.

Step 4. Build the real-time market data layer with consistency guarantees

In a Forex platform, real-time execution is inseparable from real-time market data. Price feeds drive order validation, risk checks, and execution decisions. This means the platform must treat market data as a single source of truth, with clearly defined rules for normalization, update frequency, and fallback behavior.

A scalable setup typically combines streaming channels (for live prices and trading screens) with request-based APIs (for snapshots, history, and reconciliation). The critical challenge is consistency: the price visible to the trader must align with the price used internally for decision-making. Any mismatch increases dispute risk and undermines trust, especially during periods of high volatility.

From an architectural standpoint, market data pipelines must be designed for bursts. Forex markets generate uneven load, and systems must absorb spikes without dropping updates or introducing hidden latency.

While market data ingestion itself was outside the scope of the Synergy FX project, the digital platform was designed to support price transparency at the experience level. During the discovery phase, we identified that users expected clear explanations of pricing models and execution conditions before engaging with the platform.

As a result, the information architecture and UX emphasized transparency and clarity, ensuring that how pricing and execution were communicated aligned with the broker’s actual trading model. This alignment reduced the gap between user expectations and real trading behavior, which is critical for long-term trust in a live trading environment.

Real-time execution in Forex relies on the same principles as portfolio and investment platforms: consistent market data, deterministic state management, and low-latency decision paths. This guide, “How to Build an Investment Management Platform With Real-Time Market Data,” explores these principles from the perspective of an investment platform.

Step 5. Implement deterministic order lifecycle management

Order handling is the point at which user intent becomes financial liability. A production-grade Forex platform must implement a deterministic order lifecycle in which every order follows a clearly defined sequence from submission and validation through execution, partial fills, cancellation, or rejection.

This layer is central to forex brokerage platform development because it must remain reliable under retries, network instability, and concurrent requests.

Idempotency is critical: repeated client requests must never result in duplicated orders. Every state transition should be traceable, timestamped, and auditable for both operational monitoring and regulatory reporting.

When order state logic is fragmented or loosely enforced, platforms tend to exhibit hard-to-reproduce failures—orders stuck in intermediate states, balance mismatches, or conflicting execution statuses. These issues typically surface during peak volatility, when the cost of failure is highest.

In the Synergy FX project, lifecycle clarity was addressed earlier in the funnel during onboarding and account creation. Registration and account-opening flows were designed to be predictable and unambiguous, reducing the risk of inconsistent account states later in the trading journey.

By eliminating uncertainty before users reached trading systems, the platform reduced operational friction and support overhead once live trading interactions began.

Step 6. Integrate pre-trade risk controls directly into execution paths

In Forex systems, risk management cannot operate as a post-processing layer. Margin checks, exposure limits, leverage rules, and stop-out conditions must be enforced before an order is accepted for execution.

This approach is a defining characteristic of enterprise-grade forex trading software solutions. Risk engines must operate with low latency, rely on synchronized pricing and balance data, and return deterministic decisions under load. Any asynchronous or delayed validation increases systemic exposure and regulatory risk. Architecturally, this requires tight coordination among pricing, account state, and execution logic without introducing circular dependencies that would slow the critical path.

Although internal risk engines were outside the scope of the Synergy FX engagement, risk awareness directly influenced UX and content decisions. Onboarding flows, disclosures, and calls to action were structured to reflect a disciplined, regulated trading posture. This ensured that user expectations regarding responsibility and structure were established well before execution, reinforcing trust in the platform’s operating model.

Step 7. Design the platform around a resilient execution and operations stack

Execution reliability depends not only on business analysis and logic, but on the underlying systems that transport data, manage state, and absorb load. Messaging, observability, and failure isolation must be treated as first-class architectural concerns.

These requirements directly shape the forex trading technology stack from event-driven messaging and persistence strategies to monitoring, alerting, and rollback mechanisms. Systems must be designed to degrade gracefully under stress, preserving core trading functions even when non-critical components fail.

Without this operational foundation, application-level performance optimizations deliver diminishing returns, especially during unpredictable market events.

For Synergy FX, the digital platform was intentionally designed as an independent entry layer, separated from internal trading systems. Content delivery, regional pages, and marketing updates could evolve without introducing dependencies on execution or risk logic. This approach reduced operational coupling and allowed the business to scale its digital presence more safely.

Step 8. Prepare the platform for future asset expansion without re-architecture

Even when launching as a Forex-only product, platforms should be designed with asset extensibility in mind. Different instruments introduce different pricing models, risk profiles, settlement rules, and reporting requirements.

This foresight is essential for multi-asset trading platform development. Without it, adding new asset classes later often requires invasive changes to data models, order handling, and compliance workflows, significantly increasing cost and risk.

Designing for extensibility early allows teams to introduce new instruments incrementally, without destabilizing existing Forex operations.

Synergy FX focused on strengthening its Forex offering first, but the digital structure was designed to support future expansion. Information architecture, navigation, and content hierarchy were built to scale without locking the platform into a single-product mindset. This balance allowed the broker to grow confidently without overengineering capabilities that went unused.

Step 9. Validate the platform under real market stress, not just functional tests

Functional correctness is only the baseline. A Forex platform must be validated under real-market stress conditions, including volatility spikes, sudden liquidity drops, news-driven surges, and simultaneous user activity across regions. These scenarios expose issues that are invisible in standard QA cycles.

At this stage, teams should focus on load testing, stress testing, and failure simulations across the entire execution path: market data ingestion, order intake, validation, and user feedback loops. The goal is not perfect uptime, but predictable behavior under pressure, clear rejections, consistent balances, and graceful degradation instead of silent failures.

This level of validation is a hallmark of mature fintech software development for forex, where platform reliability is measured by behavior under worst-case scenarios.

For Synergy FX, testing focused on the digital layer under growth conditions rather than trading logic itself. The website and regional pages were validated against increasing traffic volumes to ensure stable performance during campaigns and geographic expansion. This approach helped prevent front-end bottlenecks from becoming a perceived “platform issue” during periods of increased market activity.

Step 10. Embed security, compliance, and auditability into the system design

In regulated Forex environments, security and compliance are architectural properties. Every user action, order state change, and system decision must be traceable, timestamped, and reconstructible for audits and dispute resolution.

This requires structured logging, immutable audit trails, and consistent identity and access controls across services. Encryption, authentication, and role-based access should be enforced by design, not layered on later. When compliance is treated as an afterthought, platforms often face costly retrofits or operational risks when regulators or partners become involved.

This step is especially critical when delivering custom forex trading software, where responsibility for compliance behavior cannot be shifted to third-party vendors.

In the Synergy FX project, regulatory credibility was reflected at the experience level. Content structure, disclosures, and UX patterns were designed to communicate transparency, consistency, and professionalism, key trust signals for regulated trading environments. While internal compliance systems remained untouched, the digital interface reinforced the broker’s disciplined operating model from the first interaction.

Execution stability means little without strong security and auditability. This article on “How to Implement Enterprise Cybersecurity for Financial Services Companies” explains how financial platforms protect data, transactions, and infrastructure while meeting regulatory expectations.

Step 11. Launch incrementally and scale the platform in controlled phases

A successful launch strategy prioritizes control over speed. Rather than exposing the full platform to maximum load immediately, teams should roll out functionality and regions in phases, closely monitoring system behavior and user interaction patterns.

This includes progressive traffic increases, feature flags, and region-by-region expansion, combined with real-time monitoring and alerting. Scaling decisions should be driven by observed system behavior, not forecasts alone. The objective is to grow without introducing instability into execution or support workflows.

This disciplined approach defines how teams ultimately build forex trading platform solutions that can scale with the business, instead of collapsing under early success.

Synergy FX expanded its online presence through the incremental rollout of regional pages and localized content. This allowed the business to validate performance, conversion behavior, and operational readiness before accelerating growth.

By scaling the digital layer in controlled steps, the broker avoided unnecessary risk while strengthening its market position.

Evaluate the engineering effort behind real-time pricing, order routing, and risk controls. Get a detailed delivery estimate from trading-system specialists.

Key challenges teams face when you build a Forex trading platform

When teams decide to build forex trading platform solutions at scale, the biggest obstacles rarely surface during consulting and early development. Most challenges emerge later—when real users, real money, and real market volatility collide with architectural assumptions made months earlier.

Many teams underestimate how tightly execution logic, risk controls, and growth initiatives become intertwined as the platform evolves. Without clear boundaries, even minor changes introduced for acquisition or regional expansion can cascade into latency issues, unstable order behavior, or operational blind spots that are difficult to diagnose once the system is live.

Key challenges include:

• Tight coupling between execution logic and user acquisition layers, where growth-related changes start affecting order latency and system stability.

• Underestimating peak volatility scenarios and designing systems for average load rather than market stress conditions.

• Inconsistent synchronization between pricing, risk checks, and account balances under concurrent trading activity.

• Difficulty scaling traffic and regional expansion without introducing operational instability.

• Architectural debt caused by rushing MVPs into production without a clear evolution path.

• Limited observability makes incidents hard to reproduce, diagnose, and explain to regulators or clients.

• Balancing speed to market against long-term maintainability and compliance readiness.

Business and operational benefits of a proper architecture

Strong forex trading platform development directly affects revenue stability, operational efficiency, and the company’s ability to grow with confidence. When architecture is designed with execution isolation and determinism in mind, teams gain control over how the platform behaves under both normal and extreme conditions.

A sound architecture enables business growth and independent trading operations. This separation reduces change costs, lowers operational risk, and provides leadership with clearer visibility into system health and performance as the platform scales.

Key business and operational benefits include:

• Predictable order execution and account behavior during both normal and high-volatility market conditions.

• Reduced operational risk and lower support load during traffic spikes or market events.

• Faster regional expansion and localization without destabilizing core trading systems.

• Easier compliance audits through clear audit trails and deterministic system behavior.

• Greater confidence in scaling user acquisition and marketing initiatives.

• Improved ability to isolate, diagnose, and resolve incidents without widespread disruption.

• A stable foundation for future product growth without recurring platform rewrites.

As Forex platforms increasingly intersect with payments, onboarding, and financial services beyond trading, execution architecture alone is not enough. This overview of the ”Top 15 Embedded Finance Software Development Companies in 2026” highlights teams experienced in building finance-native platforms that scale across products and regions.

Forex platform trends that actually matter in 2026

In 2026, meaningful platform innovation is less about adding features and more about how systems are owned, evolved, and operated over time. Mature teams are shifting away from rigid vendor platforms toward approaches that give them deeper control over execution behavior, resilience, and long-term scalability.

This shift is driven by the growing complexity of forex trading infrastructure, where execution quality, observability, and compliance expectations can no longer be abstracted away behind generic tooling. As a result, more organizations are investing in custom investment software development to retain architectural flexibility and reduce long-term dependency risks.

Rather than chasing hype, teams are prioritizing deterministic execution, operational transparency, and architectures that can survive sustained growth and market stress without constant rework.

How Computools can help you build a production-ready Forex platform

Building a Forex platform requires deep domain expertise, execution-first architecture, and readiness for regulatory and operational pressure. Computools provides fintech software development services for banks, fintechs, insurers, and investment firms operating in high-load, regulated environments.

With over 12 years of experience, more than 250 experts, and over 20 fintech projects delivered for international companies, we develop and implement trading and investment platforms, as well as risk, compliance, transaction monitoring, and financial analytics systems that stay reliable in volatile markets and scale predictably as businesses expand.

Companies choose Computools for custom finance software development when off-the-shelf platforms limit control over execution, scalability, or compliance flexibility.

We help financial businesses move faster without compromising reliability, security, or trust. Planning a Forex or trading platform? Let’s discuss your project at info@computools.com.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”