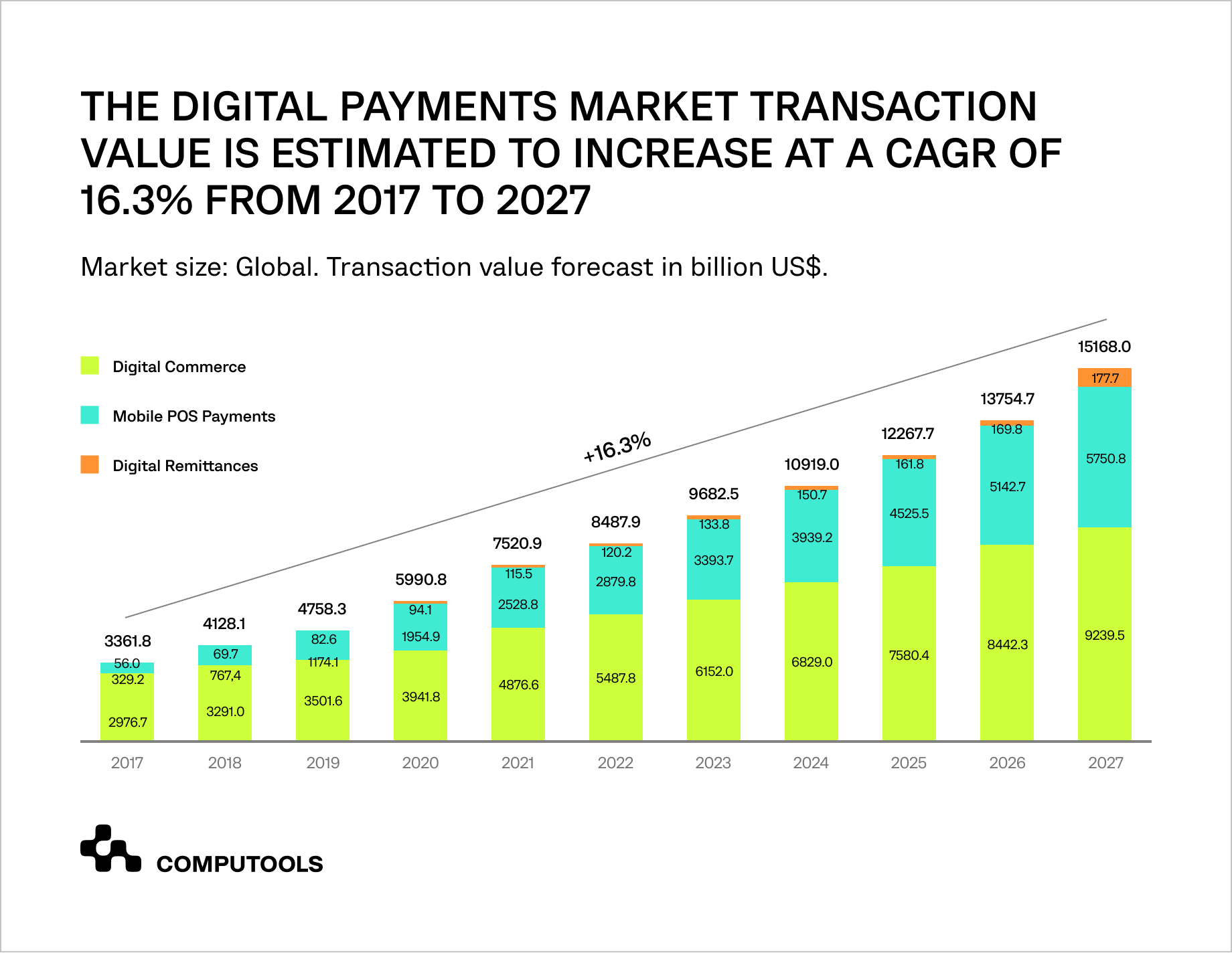

Statista and multiple global market studies highlight the rapid expansion of digital payments and mobile wallets worldwide. According to the Nasdaq WALLET Index Research Commentary (Q2 2024), the total value of digital payment transactions is projected to surpass $16.62 trillion by 2028, driven primarily by the accelerated adoption of mobile wallets, embedded finance, and frictionless digital commerce.

Moreover, a recent Wiseasy global overview reports that the mobile wallet market continues to grow at double-digit rates, fueled by ecommerce penetration, the rise of contactless payments, and merchants’ shift toward digital-first customer experiences.

Top 20 eWallet App Development Companies in 2026:

1. Computools

2. Andersen

3. Intellias

4. Netguru

5. MobiDev

6. Innovecs

7. ELEKS

8. Sigma Software

9. S-Pro

10. Itexus

11. LeewayHertz

12. Appinventiv

13. Sidebench

14. Simpalm

15. Light IT Global

16. OpenGeeksLab

17. Hyperlink Infosystem

18. Oxagile

19. DevTechnosys

20. Fueled

Asia-Pacific remains the world’s largest digital wallet market, accounting for the highest transaction volume and fastest user growth due to widespread smartphone adoption, QR-based payments, and government-backed digital initiatives.

North America and Europe follow, demonstrating strong momentum as digital wallets become central to online retail, transportation, hospitality, and cross-border transactions.

Key global adoption drivers include:

• Seamless checkout experiences that reduce friction for online shoppers

• Lower transaction friction and faster payments for merchants and consumers

• Improved fraud prevention through biometrics, tokenization, and advanced risk scoring

• Cross-border operability supporting multi-currency and international transfers

• Instant payouts and digital onboarding, enabling wallets to replace traditional banking workflows

Who develops eWallets today? A wide range of industries actively invest in mobile wallet app development services: retailers and marketplaces, traditional banks, neobanks, fintech startups, telecom operators, transport ecosystems, super-app platforms, and SaaS providers.

Many of these organizations collaborate with teams specializing in custom mobile app development to build secure, high-performance wallet solutions tailored to their business models. Their primary goals are to increase payment speed, improve user experience, reduce operational costs, and unlock new revenue streams within digital financial ecosystems.

Selection criteria: how we chose the leading eWallet app development companies

1. Proven Fintech Expertise

We prioritized eWallet app development companies with hands-on experience in digital banking, payment processing, and regulatory compliance (KYC/AML, PCI DSS). This ensures reliable delivery of secure custom eWallet software solutions for regulated markets.

2. Security-First Development

Selected vendors demonstrate strong capabilities in encryption, identity verification, fraud prevention, and automated risk management — essential qualities when choosing a long-term payment app development partner.

3 High-Load & Scalability Readiness

Digital wallets must perform under peak transaction volumes. We focused on companies known for building scalable, high-availability architectures with resilient APIs and transaction pipelines for ecommerce and fintech platforms.

4. Modern Architecture & Engineering Maturity

We evaluated teams using microservices, cloud-native infrastructure, CI/CD automation, and robust API orchestration. These practices support faster iteration and flexible models, including white label eWallet app solutions.

5. User-Centric Experience Design

Ease of use is critical. We selected vendors that deliver intuitive onboarding, seamless payment flows, biometric authentication, and mobile-first UX, ideal for eWallet app development for startups and consumer-focused businesses.

6. Emerging Technology Expertise

Many shortlisted companies offer experience with crypto wallets, tokenization, smart contracts, and Web3 technologies, enabling advanced digital wallet features and future-ready financial products.

Top 20 eWallet App Development Companies

1. Computools

Computools stands out as a top eWallet app development company thanks to its strong engineering culture and deep specialization in financial technology. With 12+ years of software engineering expertise and a global team of 250+ engineers, the company has delivered 400+ custom software products for clients worldwide, including 20+ custom fintech platforms spanning banks, PSPs, eWallets, crypto solutions, lending systems, regtech, and investment technology.

The team designs end-to-end digital wallet ecosystems that combine secure transaction engines, intuitive onboarding flows, fraud-detection modules, and multi-currency capabilities tailored for ecommerce, retail banking, and digital-first enterprises. As a secure eWallet mobile app developer, Computools builds microservice-based architectures engineered for high-load financial operations, real-time data routing, and seamless integrations with Visa, Mastercard, SWIFT, and leading payment service providers.

A key differentiator is the company’s focus on modernization. Through enterprise-grade fintech software development services, Computools helps organizations transform legacy payment systems, automate compliance workflows, enhance user experience, and significantly reduce time-to-market.

All solutions are engineered to meet PCI DSS, SOC 2, GDPR, PSD2, DORA, and KYC/AML requirements and are delivered using ISO 9001 and ISO 27001–aligned workflows and security practices, ensuring consistent quality management and robust information security across global markets.

This expertise is reflected in real-world fintech case studies, including Finmap Online (financial management platform), Crypthusiast (cryptocurrency exchange and social network), Invest Latam (investment and trading ecosystem), and Generation Group (digital finance and wealth management solutions), demonstrating Computools’ ability to build secure, scalable, and user-centric digital wallet and financial platforms across diverse markets.

Whether delivering consumer wallets, merchant wallets, or embedded finance modules, Computools consistently demonstrates the precision, security, and scalability expected from an industry leader, firmly positioning the company as a dominant force in digital wallet engineering heading into 2026.

2. Andersen

Andersen is a well-established engineering powerhouse in the fintech domain, known for delivering digital wallets, core banking systems, credit engines, and enterprise payment hubs.

The company excels at building secure and compliant infrastructures that handle complex KYC/AML workflows, real-time settlement, and large-scale transaction reconciliation. With strong expertise in cloud-native systems and PCI DSS–ready architectures, Andersen supports both traditional financial institutions and disruptive fintech brands.

Their teams emphasize continuous delivery, integration readiness, and long-term product evolution, making Andersen a reliable partner for organizations seeking highly scalable wallet ecosystems.

3. Intellias

Intellias is recognized for its deep involvement in digital banking, mobility payments, tolling systems, and embedded finance solutions.

The company builds high-load wallets designed for millions of concurrent users, incorporating biometric authentication, AML/KYC automation, and intelligent onboarding flows. Intellias brings strong analytical capabilities and experience with regulated environments, making it an appealing choice for neobanks, transportation networks, and enterprises requiring robust financial infrastructure.

Their architectural approach emphasizes resilience, fraud resistance, and clean integrations with multi-channel payment systems.

4. Netguru

Netguru combines product strategy, modern UI/UX design, and strong mobile engineering to deliver polished financial applications at speed. Known for supporting fintech startups and innovation-driven enterprises, the company builds digital wallets that feature intuitive checkout flows, budgeting tools, rewards mechanisms, and microtransaction logic.

Their rapid MVP development approach enables clients to validate ideas early and iterate quickly. Netguru also supports full-scale development for enterprises seeking long-term wallet modernization, integration with PSPs, and customer-centric payment experiences.

5. MobiDev

MobiDev brings strong machine learning and behavioral analytics capabilities into the digital wallet space. Their systems use AI-driven fraud detection, anomaly scoring, and dynamic risk evaluation to protect users and merchants. The company builds cross-platform wallets for ecommerce, retail loyalty programs, transportation, and event ticketing, focusing heavily on transaction safety and IT infrastructure reliability.

MobiDev’s combination of mobile engineering and predictive analytics makes it a strong choice for businesses requiring proactive fraud prevention and smooth cross-device payment experiences.

Examine how next-generation eWallet development supports interoperability, regulatory readiness, and rapid market expansion.

6. Innovecs

Innovecs specializes in digital ecosystems with extremely high transactional intensity. Their wallet solutions support gaming platforms, merchant cash-out systems, multi-currency payment hubs, and instant settlement engines. Innovecs emphasizes concurrency, performance optimization, and real-time event processing — essential for applications that must handle thousands of simultaneous operations.

This makes the company particularly well-positioned to serve gaming, entertainment, and marketplace sectors that rely on fast, frictionless financial flows.

7. ELEKS

ELEKS delivers enterprise-grade payment architectures for neobanks, corporate finance departments, and large financial institutions. Their digital wallets integrate deeply with ERP systems, treasury tools, risk engines, and compliance modules. ELEKS is known for its rigorous engineering approach: cybersecurity audits, high-availability clusters, and adherence to global financial regulations.

Their strength lies in building long-term, scalable ecosystems that support complex business logic and operational continuity — ideal for organizations requiring stability and strict compliance.

8. Sigma Software

Sigma Software develops tailored payment ecosystems, white-label wallets, loyalty systems, and transport fare solutions. Their subject matter expertise covers multi-tenant platforms, telecom integrations, and API-driven architectures that allow large businesses to launch wallets across multiple customer segments.

Sigma Software is also experienced in designing modular payment components, enabling companies to extend wallet features with rewards, lending modules, or subscription payments.

This makes them a strong choice for telecoms, transportation networks, and enterprises seeking flexible digital payment tools.

9. S-Pro

S-Pro is an industry-recognized leader in blockchain-enabled payments and Web3 financial platforms. The company builds both conventional digital wallets and advanced cryptocurrency wallet app systems that support tokenization, cross-chain transactions, and smart-contract logic.

Their expertise is particularly valuable for fintech brands entering the blockchain space or building hybrid financial architectures that combine traditional payment rails with decentralized elements. S-Pro’s engineering depth has made them a go-to partner for crypto exchanges, neobanks, and digital asset startups.

10. Itexus

Itexus is known for building automation-driven financial products: bill payment engines, mobile onboarding modules, loan repayment systems, and consumer banking wallets.

Their solutions emphasize operational efficiency, identity security, and reliable transaction processing. Itexus has strong experience working with regional banks, credit unions, and SME-focused financial institutions.

Their ability to integrate with legacy systems while modernizing user experience makes them a strong partner for institutions undergoing digital transformation.

11. LeewayHertz

LeewayHertz is one of the most advanced Web3-focused engineering firms in the market, specializing in decentralized payments, token issuance, digital identity frameworks, and crypto wallet infrastructures.

Their platforms often include multi-chain interoperability, hardware wallet integration, and enhanced smart-contract verification. LeewayHertz is frequently chosen by enterprises exploring blockchain-based compliance, asset tokenization, and next-generation financial ecosystems that go beyond traditional banking.

12. Appinventiv

Appinventiv is highly sought after by early-stage fintechs because of its strong delivery speed and startup-oriented product mindset. The company builds cross-platform digital wallets, BNPL solutions, merchant payment systems, rewards engines, and micro-lending apps.

Their structured MVP approach ensures efficient validation and rapid product-market fit. Appinventiv also supports scaling beyond MVP, helping clients expand into new markets, integrate additional PSPs, or evolve wallet functionality as user needs grow.

13. Sidebench

Sidebench is a US-based innovation studio and payment app development firm specializing in consumer-centric mobile wallets. Their work emphasizes exceptional UX, fraud mitigation, behavioral analytics, and seamless cross-device consistency.

Sidebench has experience in healthcare, hospitality, entertainment, and retail — industries that require wallet experiences that are intuitive, compliant, and tightly integrated with broader service ecosystems. Their design-driven methodology produces highly polished and commercially viable financial apps.

14. Simpalm

Simpalm focuses on mobile-first payment experiences for US-based clients, including loyalty wallets, retail payment systems, event wallets, and proximity-based contactless payment app solutions. Their engineering teams frequently work with NFC, QR, geolocation, and Bluetooth-based interactions.

Simpalm is a strong fit for retail, transportation, and consumer services that rely on fast, tap-and-go payment mechanisms and location-aware financial flows.

15. Light IT Global

Light IT Global specializes in data-driven financial applications, delivering digital wallets enhanced with AI-based scoring, user categorization, and transaction intelligence.

Their platforms often include predictive risk analysis, automated spending insights, and integration with credit assessment systems. Light IT Global is especially valuable for fintech businesses looking to embed analytics deeply within their payment logic.

Uncover the top 20 KYC software development firms for fintech platforms transforming identity verification, regulatory compliance, and fraud prevention.

16. OpenGeeksLab

OpenGeeksLab builds high-performance wallet solutions for ecommerce and marketplace ecosystems. Their work includes QR-based payments, instant P2P transfers, split payments, and cart-integrated checkout modules.

The company focuses on minimizing transaction friction and optimizing throughput, making them an excellent engineering partner for online retail platforms and high-volume digital commerce businesses.

17. Hyperlink Infosystem

Hyperlink Infosystem provides white-label wallets, multi-currency modules, simple crypto integrations, and PSP connectors for small and mid-sized businesses worldwide.

Their delivery and communication models are oriented toward fast time-to-market and cost efficiency, making them a strong partner for organizations that need reliable payment tools without a heavy enterprise footprint.

18. Oxagile

Oxagile develops subscription-based wallets, video-streaming payment engines, and billing systems for media and entertainment platforms.

Their wallet architectures support recurring payments, account credits, pay-per-view models, and merchant-side settlement. Oxagile’s experience in digital content ecosystems makes them a uniquely specialized provider for companies with media-driven revenue streams.

19. DevTechnosys

DevTechnosys offers modular wallet engines, merchant systems, EMI solutions, and ready-made payment components that integrate easily with third-party APIs.

Their approach enables businesses to deploy functional wallets rapidly while still being able to customize workflows, currencies, transaction limits, or compliance modules as needed.

20. Fueled

Fueled is a design-centric mobile engineering studio known for creating visually refined, user-friendly wallets for retail, hospitality, and entertainment brands. Their focus on premium UX, smooth animations, and intuitive interaction patterns results in wallets that feel elegant and modern.

Fueled blends creative excellence with solid engineering to produce payment apps that stand out in highly competitive consumer markets — a reflection of their ability to build digital wallets that are both functional and emotionally resonant.

Key fintech case studies by Computools

1. Moblet — Mobile Banking & Financial Management App

Computools partnered with Moblet, an Eastern European challenger bank entering the retail segment, to build a secure and user-friendly financial management app. The client lacked internal engineering resources and needed a fast, high-quality launch in a competitive market.

Computools reengineered the product, implementing advanced calculation algorithms, real-time transaction tracking, and integrations with SWIFT, Visa, and MasterCard. Full KYC onboarding, fingerprint login, two-factor authentication, and a modern minimalistic interface elevated both security and usability.

The resulting high-load mobile wallet strengthened Moblet’s market positioning, enhanced user trust, and provided a scalable foundation for retail banking expansion.

2. Caribbean Bank — Visa Integration & Digital Banking Modernization

Caribbean Bank, a major regional institution operating across 17 countries, needed to integrate Visa card processing and modernize its digital banking systems. Limited internal IT capacity and PCI DSS requirements complicated the process.

Computools developed a microservices software architecture services enabling real-time transaction authorization, improved payment reliability, and seamless Visa connectivity. The team also redesigned the bank’s web and mobile interfaces, creating a clearer user journey and more intuitive UI.

The upgraded platform strengthened operational performance and drove a 12% increase in younger users. With scalable architecture and PCI-aligned security, Caribbean Bank significantly improved its digital competitiveness.

Conclusion

Choosing the right partner among leading eWallet app development companies is essential for any business aiming to deliver secure, scalable, and compliant digital payment experiences. In a landscape where fintech app development companies must balance regulation, innovation, and user expectations, the ability to engineer stable high-load systems and seamless financial journeys becomes a decisive competitive advantage.

Computools distinguishes itself through deep fintech expertise, a strong engineering culture, and a portfolio of solutions proven in real-world banking and payment ecosystems. By combining advanced architecture, user-centric product thinking, and capabilities that extend into emerging areas such as blockchain development services, the company offers a future-ready foundation for digital wallets, banking platforms, and next-generation financial products.

For organizations seeking long-term innovation, operational efficiency, and trustworthy digital finance infrastructure, Computools represents a strategic and forward-looking partner.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”